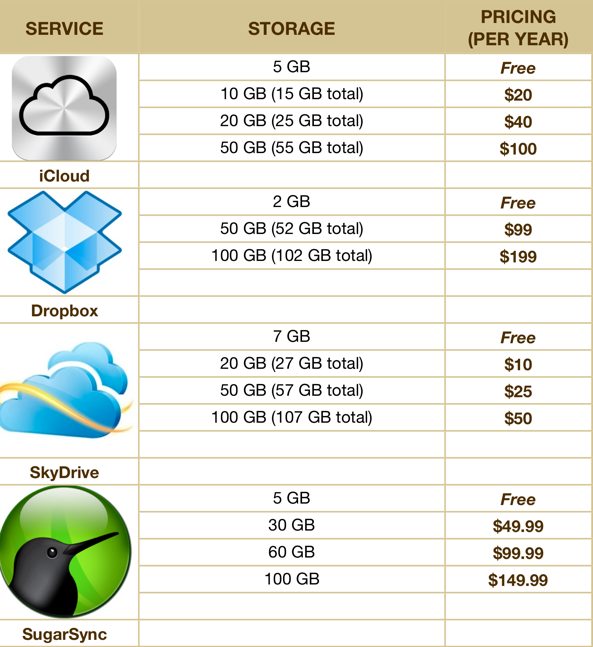

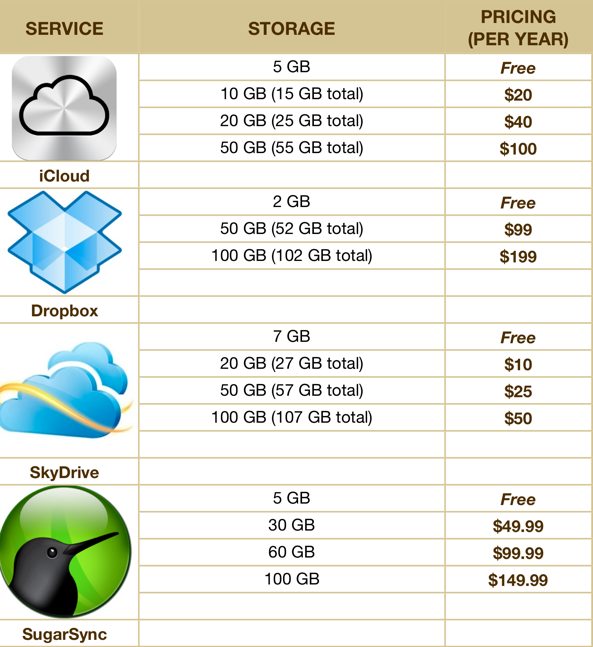

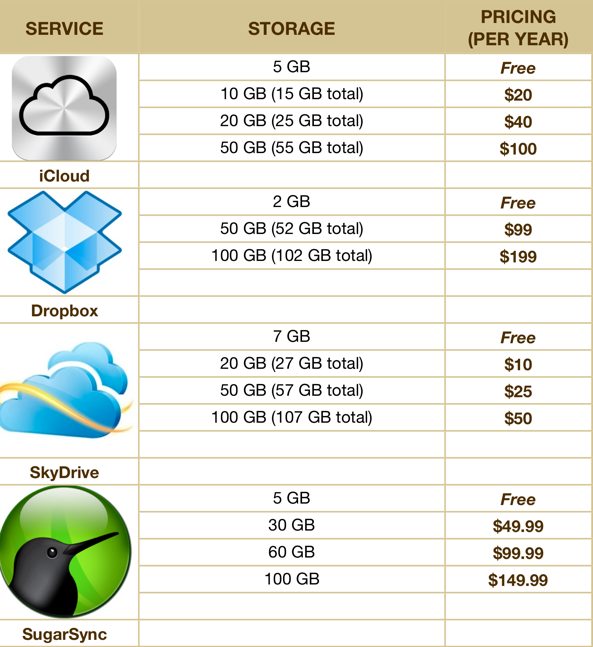

The main competitors are Google, with their product google drive, and Microsoft with One Drive. It also has $USD1.1 billion in revenue from those users. Average Revenue Per Paying User at $110. As of 2017, it has 11 Million paying users. The company has roughly 500 million registered users, which has been growing at a very strong rate of ~30% YoY. They monetise by giving the user expansions of data control and storage sizes for a monthly fee. Dropbox is a cloud storage company for both enterprise and individual use. Dropbox rundownīefore I delve deeper into the company I will give you a quick summary of what Dropbox does, who are their competitors and how they’re monetising their platform: Whereas if you want to represent this qualitatively, a great company provides an excellent product with an incredible competitive advantage that means its users will be tolerant of price increases. Quantitatively, a companies value is simply the net present value of its future cash flows, or in laymen, the amount of cash a company can generate for over the course of its life discounted by the value of time (a dollar tomorrow is worth less than a dollar today). What is important to clarify in this writing is what actually makes a company valuable in both quantitative and qualitative terms. What I found is that despite from what on the outside seemed to be a massive target to be ‘googled’ by Google Drive turns out to be an extremely, what Warren Buffet calls, ‘sticky’ product. To tackle this I did what all prospective investors should do, and read through the S-1 prospectus. I was being asked to try and sum up a whole business’s quality through one number. At first, I found this question confronting. Recently, I was asked what was the most important metric of business quality for Dropbox.

The main competitors are Google, with their product google drive, and Microsoft with One Drive. It also has $USD1.1 billion in revenue from those users. Average Revenue Per Paying User at $110. As of 2017, it has 11 Million paying users. The company has roughly 500 million registered users, which has been growing at a very strong rate of ~30% YoY. They monetise by giving the user expansions of data control and storage sizes for a monthly fee. Dropbox is a cloud storage company for both enterprise and individual use. Dropbox rundownīefore I delve deeper into the company I will give you a quick summary of what Dropbox does, who are their competitors and how they’re monetising their platform: Whereas if you want to represent this qualitatively, a great company provides an excellent product with an incredible competitive advantage that means its users will be tolerant of price increases. Quantitatively, a companies value is simply the net present value of its future cash flows, or in laymen, the amount of cash a company can generate for over the course of its life discounted by the value of time (a dollar tomorrow is worth less than a dollar today). What is important to clarify in this writing is what actually makes a company valuable in both quantitative and qualitative terms. What I found is that despite from what on the outside seemed to be a massive target to be ‘googled’ by Google Drive turns out to be an extremely, what Warren Buffet calls, ‘sticky’ product. To tackle this I did what all prospective investors should do, and read through the S-1 prospectus. I was being asked to try and sum up a whole business’s quality through one number. At first, I found this question confronting. Recently, I was asked what was the most important metric of business quality for Dropbox.

Previously posted on my blogspot at Billson Porter

Breaking down the most important metric of Dropbox